The following is Part IX of a multi-part series on value, segmentation and pricing by guest contributor Steven Forth, Partner at Rocket Builders and eFund Member. Read Part I here,Part II here, Part III here, Part IV here, Part V here, Part VI here, Part VII here, and Part VIII here. Steven was recently called out as one of the top experts in B2B software pricing by OpenView Labs in Boston.

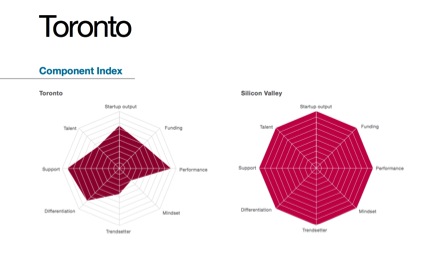

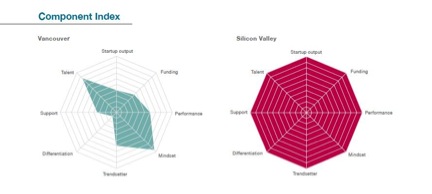

April 1, 2015, Vancouver. New Ventures BC has a sense of humour so they chose me as the guest speaker for April Fool’s Day! My talk was on business models and the need to innovate on your business model and not just your technology or product. I used the above image in my talk. It is the result of research from Betakit based on the Startup Genome project. The data are from 2012 and it is not too late to contribute to this year’s survey, which will come out in May.

I was using this to reinforce a point about the need for differentiation and that differentiation is as likely to come from innovation on the business model as technology or even product. But the slide provoked the most interesting question of the evening.

“Why is Vancouver so low on differentiation?”

Why indeed. I turned the question back on the audience and there were some useful thoughts.

“It comes down to culture. Canadians trend more towards the mean and are not as willing to stand out.”

Maybe. But then Toronto should have the same issues. So how does Toronto look? Toronto was rated 8th, just ahead of Vancouver (the other Canadian city on the list was Waterloo, 16th between 15th place Berlin and 17th place Singapore).

Interesting. Vancouver does much better on Talent and Mindset, but Toronto does reasonably well on Differentiation (it also does well on Support, Startup Output and Performance). Unless we think people from Toronto are more creative than Vancouverites, or that people from Vancouver have more typical Canadian values, we are going to have to dig deeper.

Shawn Dhawan from Simon Fraser came up to me during the coffee break and suggested that Vancouverites might be afraid of failure, which would lead us to make safer decisions, which would result in less differentiation.

I know a lot of people in the innovation economy in BC. The people who step and start companies have not shown any signs of risk aversion to me. Most of them, or ‘us’ as I am one of them, have left high paid jobs and invested our own money, reputation and relationships in what we are doing. I don’t think the fear of failure comes from the entrepreneurs.

But I do think fear of failure is a contributing cause. But the fear is embedded in our investment and support systems. Many Vancouver investors think

- That low valuations are a good thing

- That getting a company to cashflow positive is a reasonable goal in itself

- That minor variations on a known business model for a niche market are the most attractive investments

These are all bad things.

When you start a company at a low valuation you set it on a trajectory for low valuation growth. You take too many shares away from the entrepreneur and do not leave enough room for subsequent large rounds, and large rounds are needed today to get really large valuations and 100X or 500X or even 1,000X returns.

Having companies focused on the most important metrics is critical. For early stage companies this is not revenue or cashflow. It will generally be some measure of use value, and then adoption, and then growth. Optimizing for revenue, or even worse, for being cashflow positive, too early stunts growth. But that is what many Vancouver investors push on companies.

And the easiest way to get to cashflow is to copy a known business model with some small tweak, often by taking a known solution and targeting it at a small well-defined market.

I know, I often tell companies they need a small well-defined entry market, but I do mean entry-market and the company has to be designed to scale way beyond an entry market. And the goal of establishing an entry market is not to optimize revenue or cashflow, but to build a base for expansion.

Why are Vancouver investors so conservative, focused on getting low valuations and pushing companies to cashflow positive? I think it is because we know just how hard it is going to be to raise the next round. Vancouver scores very badly on both Differentiation and Funding, and the two are linked. Poorly funded companies can’t afford to create highly differentiated solutions. Companies going after niche markets with a ‘me to’ business model don’t warrant high valuations or sustained investment – they should be able to get to cashflow positive quickly.

One of the big challenges of Vancouver is the depleted state of the local venture capital market. People will tell you that this doesn’t really matter because Bay Area and Seattle VCs are willing to invest here. But it does matter. Early-stage investing is a relationship business. Entrepreneurs invest in getting to know the investors and supporting them (yes, entrepreneurs need to support investors). Yes a few extraordinary companies with great leaders are able to break through; usually because they have preexisting relationships. But overall, the failure of local VCs is dragging down the whole economy. This is something we need to change (I don’t think the VCs or government will change this, at least not initially, I think that it is up to the angel investors and the superstar companies we have here).

There may be one other reason Vancouver companies lack differentiation. That is simply proximity (mental proximity) to the Bay Area. Many of us spend time obsessing about Silicon Valley and think that the ideas and norms that work there will work here. Maybe. But I think we will be much better off if we discover our own ways to build an innovation ecosystem, with its own roots, and own ways of driving differentiation and rapid adaptation.

So, agree or disagree? What are your reasons Vancouver companies lack differentiation?

Steven Forth is a Vancouver consultant, investor and serial entrepreneur. He is a partner at Rocket Builders where his work is focused on market strategy including market segmentation, pricing and the design of revenue generation systems. He invests througheFund where he occasionally leads due diligence teams. His newest venture is TeamFit, a VentureLabs start-up building a platform for team building and collaboration.

Steven Forth is a Vancouver consultant, investor and serial entrepreneur. He is a partner at Rocket Builders where his work is focused on market strategy including market segmentation, pricing and the design of revenue generation systems. He invests througheFund where he occasionally leads due diligence teams. His newest venture is TeamFit, a VentureLabs start-up building a platform for team building and collaboration.