Thank you to guest writer Steven Forth for sharing his expertise in 2014 with his excellent guest posts. We’re thrilled to have Steven contribute more content in 2015, starting with this next post.

Early in the new year. A settling and focusing time after the celebrations of December. The days are already getting longer, but are still so short as to concentrate attention on the future.

Early in the new year. A settling and focusing time after the celebrations of December. The days are already getting longer, but are still so short as to concentrate attention on the future.

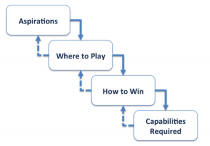

For the past few years I have been using Cascading Choices as a way to frame strategy conversations at companies and for my own personal planning. Cascading choices were developed by Roger Martin (a co-founder of Monitor Group and the former Dean of the Rotman School at the University of Toronto). It is a simple framework that starts with aspirations and then cascades down through choices about where to play, how to win and the capabilities required. A good introduction can be found in this short article Leading With Intellectual Integrity by Roger Martin and A.G. Lafley (former CEO of Proctor and Gamble).

Over the closing days of 2014 I had a variety of conversations on aspirations for the British Columbia innovation community for 2015 that I think are worth sharing.

We need some exits and we need to grow some large local companies

OK, this is not really an aspiration; it is more a pre-condition for success. People invest money, they need to be able to get that money out and do so at a high return. Otherwise they stop investing. And that means we need some exits through IPOs or large (nine and ten figure) acquisitions. These have been scarce in BC as late. Will that change in 2015? There are some companies that seem to be doing extraordinarily well and that may be able to go public in 2015. Hootsuite is the one everyone talks about, but there is also Build Direct and Vision Critical, and on a smaller scale companies like Clio and Aquatics Informatics. Why IPOs and not acquisitions? Because we need some large home grown companies to anchor the community. Development labs from outside will not do this. We need to know how to build big, innovative companies locally. Companies that will ground careers and give people experience in driving fast growing companies.

Investors need to work together and commit

Vancouver suffers from a lack of strong venture capital firms and large angel investors (individuals who reliably put seven figure amounts into early-stage companies). And we are not going to grow those companies with nine and ten figure exits until we start investing more money, a lot more money. Some people say there is not enough capital in the province and we have to attract money in from elsewhere. I call BS. There is a lot of capital here, it is just not co-ordinated or directed into tech. Why not? Because we are not getting the big exits. Why aren’t we getting the big exits? Because we are not investing enough and driving companies to grow fast enough. We are caught in a negative feedback loop. So let’s change this?

How? Well, we are not going to magically get more VCs or larger angels. What we can do is to get better at investing together. This can take the form of angel funds like eFund (I am an eFund member and would like to see it expand quickly so that it can lead deals and invest more than seven figures in companies). Or angels can come together in syndicates to back companies. Of course this happens to some extent already, as happened with BitLit last year (yes, eFund invested in BitLit) a company can get momentum behind a deal and raise the money it needs locally. But we could formalize this and make it easier for angel investors to lead or join syndicates and make it simpler for companies to connect with potential syndicate leaders. Transparency here would help change up the culture.

Company leaders need to dream big – and learn to execute

Are we building things that matter? What matters? Each of us has to answer that for ourselves, but I look for three things: there is some real technology (smart people thinking hard about how to build a non-trivial piece of technology); that can change how a market works (create a new market by connecting people in new ways, make a market more efficient by providing new insights or eliminating redundancies); that will make the world a better place (kinder, more sustainably or resilient, happier, healthier). With so many companies getting started these three questions have become my first screen, and a startup has to hit at least two, preferably all three, for me to be willing to take the time.

To the CEO’s of Early-Stage Companies – Invest

One approach to a career suggests that you build your company, get some liquidity, and then retire to become an angel investor. This doesn’t work for me. I think people should begin investing early, right at the beginning of their careers, in small amounts. And then grow and diversify their investments as they gain experience. As an entrepreneur you learn a lot from investing that will help you to build a better company. And in most cases you can invest through your RRSP (the company you are investing in should be able to help you with this). So drive a cheaper car (or skip the car), tighten your belt, and invest at least a small amount in another person’s company. And get on the board of another company. One way to get a good board for your own company is to contribute to someone else’s board. Let’s build a culture in Vancouver where each company includes one director from a company that is a couple of steps ahead and one director from a raw start-up. Both can bring important perspectives and will help us to build better boards.

So my three aspirations for 2015.

- Angel investors work together to make larger investments and get behind companies in a meaningful way

- Companies focus in on building technologies that will impact markets and change the world for the better

- We build boards that include the emerging leaders in the innovation economy

So if you know someone who could add value to the board of a risky and innovative start-up, let me know. And if you are looking for board members for your start up, I want to speak with you too. (And maybe one of you will build a startup to put potential directors and companies together!)

Steven Forth is a Vancouver consultant, investor and serial entrepreneur. He is a partner at Rocket Builders where his work is focused on market strategy including market segmentation, pricing and the design of revenue generation systems. He invests through eFund where he occasionally leads due diligence teams. His newest venture is TeamFit, a VentureLabs start-up building a platform for team building and collaboration.